|

|

|||

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Demand for gold remains robust

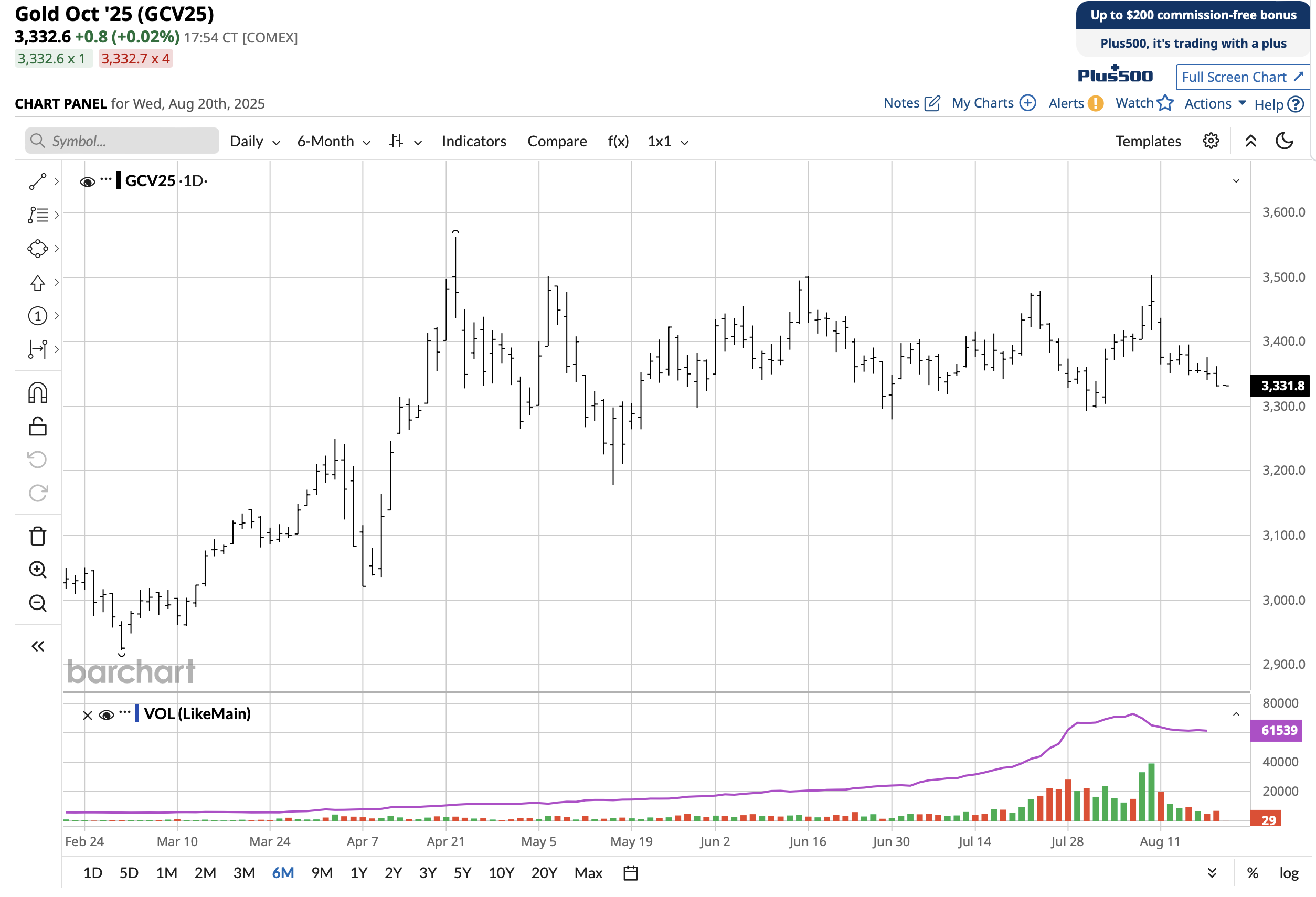

I am Stephen Davis, senior market strategist at Walsh Trading, Inc., Chicago, Illinois. You can reach me at 312-878-2391. Will interest rates go lower at the next Federal Open Market Committee (FOMC) meeting on September 16? When that happens, typically the U.S. dollar goes down and gold goes up. Gold has been on a thunderous rally this year, climbing to record highs at times in the face of uncertainties relating to geopolitical tensions and U.S. tariffs. Gold is often considered a safe-haven investment, particularly during times of economic uncertainty and inflation. In my opinion, this rally will resume and continue until the end of the year. I have a daily chart below that shows gold futures trending higher. A monthly gold chart shows six waves up, which is truly a bull market.   A trade strategy would be sell two October gold 31.50 puts for $700 each ($1,400). With that money buy December gold 3,600 call for $3,200. This strategy will cost you $1,800. The maintenance margin on Comex gold futures is $15,000 per contract. The October puts you are selling expire September 25. Notice the low on May 15 at 3,178. In my opinion, 3.200 will hold so selling the 31.50 put should be a safe play. The objective is to let the October puts you sell expire worthless. You will be left with a December gold 3,600 call. Even if gold goes to 3,400 or 3500, you will have a nice profit. If you want to discuss strategies, please contact me. Stephen Davis Direct 312 878 2391 Use this link to join my email list: SIGN UP NOW

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member. Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

This article contains syndicated content. We have not reviewed, approved, or endorsed the content, and may receive compensation for placement of the content on this site. For more information please view the Barchart Disclosure Policy here.

|

|

|