|

|

|||

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Is Verizon Communications Stock a Buy for Passive Income Investors in 2025?

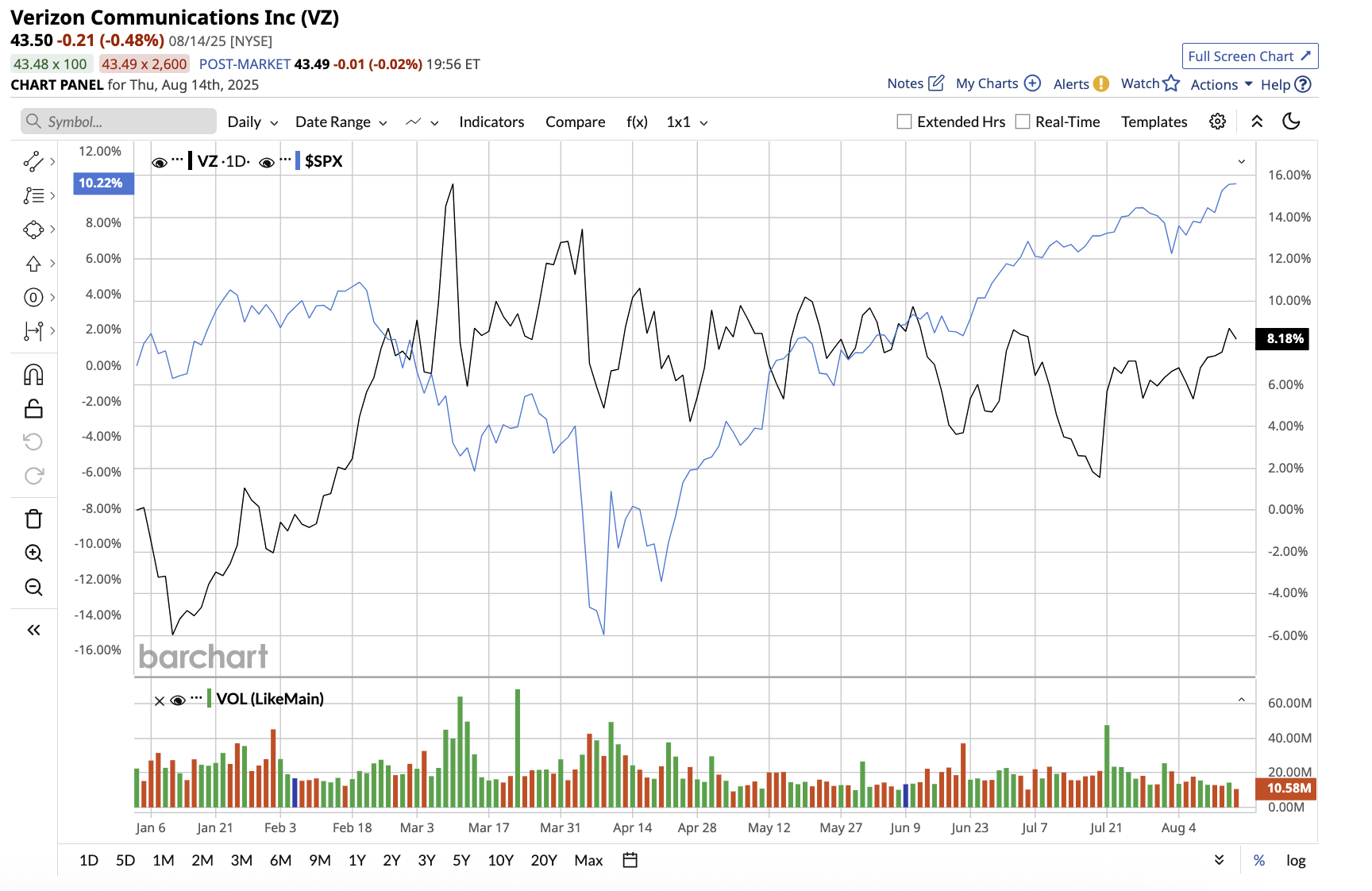

Verizon Communications (VZ) has long been a go-to dividend stock for income investors due to its consistent dividend, industry-leading network, and scale in the U.S. telecom market. It offers wireless, broadband, and other communication services to individuals, businesses, and the government. The wireless giant has a high dividend yield of 6.1%, a ,long dividend history, and a clearer picture of cash generation now that the 5G buildout is maturing. At the same time, the company operates in a saturated U.S. wireless market where adding phone subscribers has become increasingly difficult. As a result, the question arises: Is Verizon stock still a buy for income investors in 2025? Valued at $183.4 billion, VZ stock has gained 10.8% year-to-date, slightly beating the S&P 500 Index’s ($SPX) gain of 9.7%.

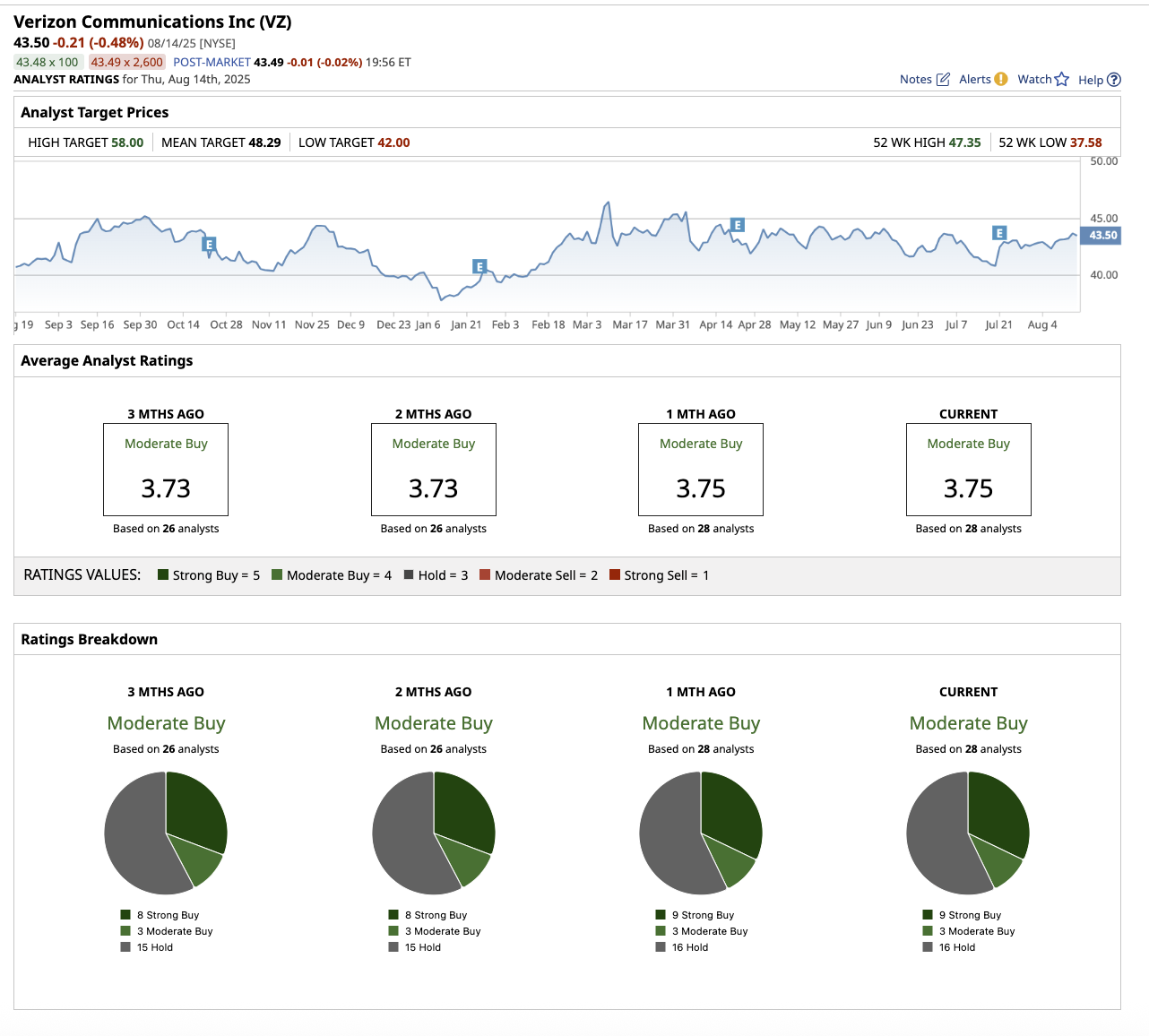

Dividend Stability: The Key Metric for Income InvestorsAside from a high yield, the most appealing feature of a good dividend stock is its consistent dividend payments and growth. Verizon has increased its dividends over the last 20 years, establishing a reputation for consistent payouts and increases. This continued quarterly payment indicates that the company intends to protect the payout even in choppier operating environments. Another factor in determining dividend safety is the amount of profits distributed as dividends, which is measured by the dividend payout ratio. Verizon’s forward payout ratio of 55.8% shows a good balance between returning money to shareholders and saving for growth initiatives. In the second quarter, Verizon reported consolidated revenue of $34.5 billion, up 5.2% year-over-year, boosted by strong wireless service revenue and wireless equipment revenue. Adjusted EBITDA increased 4.1% year on year to $12.8 billion, while adjusted earnings per share (EPS) increased by 6.1% to $1.22. Broadband remains a growth engine, with 293,000 net additions in Q2. Fixed wireless access (FWA) accounted for 278,000 of the net additions, bringing its total to 5.1 million subscribers. In the earnings call, management stated the company remains on track to reach 8 million to 9 million FWA subscribers by 2028. The upcoming acquisition of Frontier (FYBR) (pending regulatory approval) has the potential to accelerate Verizon’s fiber strategy and expand its broadband footprint. The company’s free cash flow reached $5.2 billion in the quarter and $8.8 billion year to date, an increase of more than $300 million over the same period in 2024. Free cash flow is arguably the most significant indicator in determining dividend stability. Its current debt-equity ratio is slightly higher at 1.4x. The company is continuing to reduce debt, with few maturities remaining in 2025, and has stated that share buybacks will be considered after meeting long-term leverage targets. Verizon expects to generate free cash flow between $19.5 billion and $20.5 billion in 2025. This should allow Verizon to pay down debt while maintaining dividend payments. The company raised its annual adjusted EPS growth guidance to 1% to 3%. Analysts predict that Verizon’s earnings will increase by 2.5% in 2025 and 3.04% in 2026. Verizon’s dividend appears secure for now, thanks to strong free cash flow generation, a conservative payout ratio supported by EBITDA growth, and ongoing debt reduction, all of which improve financial flexibility. Despite these advantages, investors should be mindful of potential risks, such as competitive pressures in the wireless and broadband sectors from AT&T (T), T-Mobile (TMUS), and cable providers. Furthermore, Verizon’s debt load, while manageable now, remains significant, and interest rate changes may affect refinancing costs. What Is Wall Street Saying About Verizon Stock?Overall, on Wall Street, Verizon stock is rated a “Moderate Buy.” Out of the 28 analysts who cover Verizon stock, nine rate it a “Strong Buy,” three suggest it’s a “Moderate Buy,” and 16 rate it a "Hold.” Its average price target of $48.29 suggests that the stock can increase by 11% over current levels. However, its high target price of $58 implies upside potential of 33.3% over the next 12 months.

Bottom Line: A Solid Pick for Dividend StabilityVerizon stock remains an attractive buy for income-focused investors looking for a high, stable yield backed by strong free cash flow. The company’s network leadership, disciplined financial management, and growth in broadband and private network services all help to ensure the dividend’s sustainability. While growth investors may prefer faster-moving tech stocks, those looking for a high, stable yield with moderate risk will find Verizon a compelling option in 2025. On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|